Policy Points

02.12.2009

Policy Points

December marks the second anniversary of the start of the current recession. Twenty four months after the recession’s onset, how is North Carolina’s labor market performing?

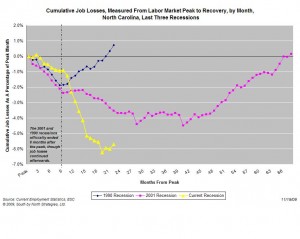

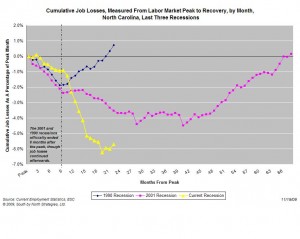

As of October (the most recent month of data), the recession had led North Carolina’s non-farm employers to eliminate, on net , 238,100 payroll positions. Consequently, payroll employment is now 5.7 percent smaller than it was in December 2007 (graph, left).

As of October (the most recent month of data), the recession had led North Carolina’s non-farm employers to eliminate, on net , 238,100 payroll positions. Consequently, payroll employment is now 5.7 percent smaller than it was in December 2007 (graph, left).

In terms of job losses, the current recession was a slow starter. Significant net losses did not start until fall 2009, with heavy losses occurring every month between 11/08 and 3/09. In fact, that period accounts for 64 percent of all the job losses that have occurred during the recession. Although the pace of job losses has moderated since April, the overall trend remains a downward one.

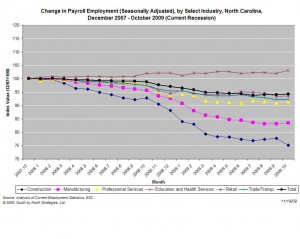

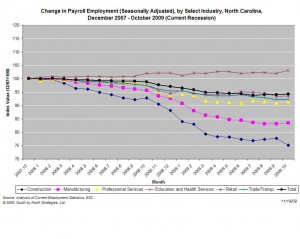

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

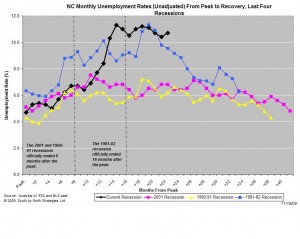

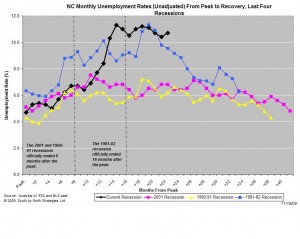

Job loss has led to a rapid increase in unemployment. Since the start of the recession, the state unemployment rate has more than doubled, rising to 11 percent from 4.7 percent. The unemployment rate now is at a level last seen during the recession of the early 1980s (graph, below). Due to limitations in the ways in which unemployment is calculated, the number of individuals who are effectively jobless likely is higher. Consider: North Carolina’s labor force now is smaller than it was at the start of the recession. Similarly, the share of the prime-age population engaged in economically productive activities has fallen.

In geographic terms, unemployment has been widespread. As of October, 64 counties had double-digit unemployment rates, and 30 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 8.4 percent)

In geographic terms, unemployment has been widespread. As of October, 64 counties had double-digit unemployment rates, and 30 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 8.4 percent)

Little in the state employment data suggest that a recovery is imminent. Economic demand remains weak at the state and national levels despite the important boost provided by the federal recovery package. Even when demand does return — a date that may be a few years away, firms will have many alternatives to hiring permanent employees.

Based on current trends, North Carolina’s labor market likely will remain weak into the foreseeable future. For individuals, a weak market will result in family economic hardships, while firms will struggle to secure business. Meanwhile, the state will grapple with the resulting budget shortfalls.

02.12.2009

Policy Points

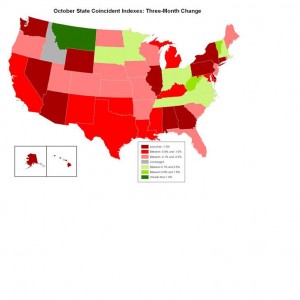

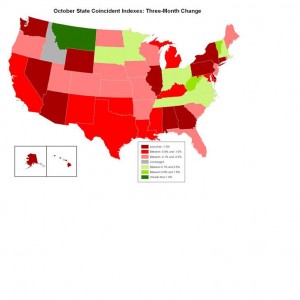

Economic conditions remained weak across much of the nation in October, according to the newest State Coincident Indexes Report prepared by the Federal Reserve Bank of Philadelphia.

In October coincident indexes moved in a negative direction in 27 states and in a positive direction in 15 states (KS, MA, MI, MN, MT, NC, NH, NJ, OH, OR, RI, TN, VA, VT, WV). No changes occurred in eight states (AR, CO, FL, IA, IN, ME, MO, NV).

The map to the right, which is taken from the Reserve Bank’ survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

The map to the right, which is taken from the Reserve Bank’ survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

Over the last three months, coincident indexes decreased in 37 states, rose in seven states (IN, MA, MN, MT, NC, NH, OH, SD, TN, VA, VT, WV) and held steady in one state: Idaho.

During the same period, North Carolina’s coincident index moved in a slightly positive direction, suggesting that economic conditions improved slightly.

01.12.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

01.12.2009

Policy Points

October saw few positive changes in local employment conditions across North Carolina. Last month, 64 counties posted double-digit rates of unemployment; of those, 30 had unemployment rates of at least 12 percent.

In October, every part of the state experienced weak labor markets. Unemployment rates exceeded 10 percent in 64 counties, and in 30 counties, at least 12 percent of the labor force was jobless and actively seeking work. County unemployment rates ranged from 6 percent in Currituck County to 17.2 percent in Scotland County.

Unemployment also remained at elevated levels in all 14 of the state’s metropolitan areas. Six metros posted double-digit unemployment rates. The Hickory-Morganton-Lenoir area had the highest unemployment rate (14.5 percent) followed by Rocky Mount (13.7 percent). The lowest metro unemployment rate was 7.6 percent in Durham-Chapel Hill.

Labor markets also were weak in the state’s three largest metro areas. In October, the unemployment rate stood at 12.7 percent in Charlotte, 11.1 percent in the Piedmont Triad, and 8.4 percent in the Research Triangle. Compared to one year ago, all three major regions had unemployment rates that were at least 1.5 times greater, along with smaller labor forces. Moreover, much of the job creation that has occurred in these areas over the past year has been in the public sector and the education and health care – fields intimately tied to public financing.

Click here to read South by North Strategies’ analysis of the October employment report.

01.12.2009

Policy Points

From the Federal Reserve Bank of Richmond’s October survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the service sector contracted more slowly in November, according to the latest survey by the Federal Reserve Bank of Richmond. The fall in retail sales halted and shopper traffic declined only slightly. In addition, the contraction in big-ticket sales slowed, owing in part to an uptick in sales of new and used automobiles. Inventory reductions nearly matched last month’s. Revenues at services firms contracted; however, the decline was not as widespread as in October. Looking ahead six months, survey respondents were much more optimistic about business prospects than they were last month.

…

Turning to service sector labor markets, job cuts diminished at retail establishments, while the number of employees edged up at services firms. Average wage growth flattened. Price change in the overall service sector turned mildly negative, damped by continuing modest price deflation at services firms. Merchants anticipated an uptick in retail price growth during the next six months, while survey respondents at services firms looked for little price change.

As of October (the most recent month of data), the recession had led North Carolina’s non-farm employers to eliminate, on net , 238,100 payroll positions. Consequently, payroll employment is now 5.7 percent smaller than it was in December 2007 (graph, left).

As of October (the most recent month of data), the recession had led North Carolina’s non-farm employers to eliminate, on net , 238,100 payroll positions. Consequently, payroll employment is now 5.7 percent smaller than it was in December 2007 (graph, left). Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

In geographic terms, unemployment has been widespread. As of October, 64 counties had double-digit unemployment rates, and 30 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 8.4 percent)

In geographic terms, unemployment has been widespread. As of October, 64 counties had double-digit unemployment rates, and 30 had rates of at least 12 percent. Even major metro areas like the Research Triangle have struggled (unemployment rate of 8.4 percent)

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed