Policy Points

19.11.2009

Policy Points

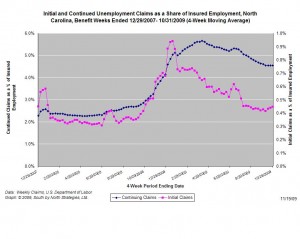

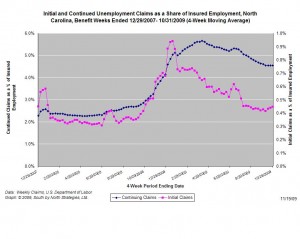

For the benefit week ending on October 31st, 18,795 North Carolinians filed initial claims for unemployment insurance, and 180,051 individuals applied for continuing insurance benefits. Compared to the prior week, there were more initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 17,715 initial claims were filed over the last four weeks, along with an average of 179,943 continuing claims. Compared to the previous four-week period, initial claims were slightly higher and continuing claims were slightly lower.

One year ago, the four-week average for initial claims stood at 18,613 and the four-week average of continuing claims equaled 118,839.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this cycle, the claims levels remain elevated and point to a labor market that remains extremely weak.

19.11.2009

Policy Points

The newest economic and revenue report prepared by the staff of the NC General Assembly suggests that joblessness and budget shortfalls will trouble North Carolina well into the foreseeable future.

Among the report’s disturbing findings are the following:

- As of October, state tax collections are running $95 million (or 1.5 percent) below target. After adjusting for changes in the tax code, revenues are down four percent compared to the previous year.

- Sales tax collections continue to plunge and are down 11.7 percent compared to the prior year.

- Withholding tax collections also are declining but are moving in line with projections.

- An employment rebound is essential to any long-term economic and revenue recovery; unfortunately, few signs point to such growth and “a robust expansionary recovery is still a year or two away.”

18.11.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

18.11.2009

Policy Points

Highlights from the latest issue of the Center for Economic and Policy Research’s Housing Market Monitor:

There appeared to be a sharp falloff in the housing market in October, as the November 30th expiration date for the first-time homebuyers tax credit approached. As expected, this credit pulled home purchases forward, leading to a substantial increase in sales in the late summer and early fall.

…

The underlying glut in housing means that it is only a matter of time before house prices begin to fall again. Delinquencies hit another record in the third quarter of 2009. The 6.25 percent 60-day delinquency rate was 58 percent above the level for the third quarter of 2008. Even with a higher percentage of delinquent homeowners now benefiting from mortgage modifications, the foreclosure rate is still running at near record levels. With unemployment virtually certain to remain high well into next year, there is little prospect for any sizable drop in foreclosures.

…

As a result, foreclosures will be putting homes on the market at an annual rate of close to a 2 million. This is guaranteed to depress prices in a market with total demand of close to 5 million. In short, house prices will almost certainly resume their decline. The only questions are how soon and how fast.

18.11.2009

Policy Points

The seasonally-adjusted prices received by producers of finished goods rose by 0.3 percent in October, according to data recently released by the U.S. Bureau of Labor Statistics. That same month, the prices received by sellers of intermediate goods rose slightly (+0.3 percent), and the prices received by sellers of crude goods advanced by 5.4 percent.

At each stage of the production process, price increases were attributable to rises in food and energy prices. When energy and food prices are excluded, producer prices for finished goods actually fell by 0.6 percent in October. Absent energy and food costs, producer prices fell for intermediate goods and rose slightly for crude ones.

Over the past year, producer prices have fallen. Unadjusted prices for finished goods have declined by 1.9 percent, and producer prices for intermediate and crude goods have dropped by 7.5 percent and 14.1 percent, respectively.

The new data offer two insights into the state of the American economy. First, the findings suggest that demand for good and services remains weak, though not quite as weak as in recent months. Second, the report indicates that inflation is not currently a threat to the larger economy.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed