17.01.2013

Policy Points

For the benefit week ending on December 29, 2012, some 28,973 North Carolinians filed initial claims for state unemployment insurance benefits and 128,803 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 17,270 initial claims were filed over the previous four weeks, along with an average of 110,469 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 18,380, and the four-week average of continuing claims equaled 125,385.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were approximately five years ago.

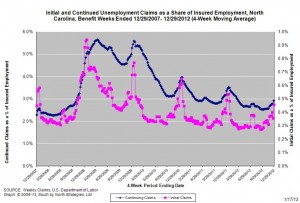

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

17.01.2013

Policy Points

Economist Joseph Stiglitz describes the various “post-crisis crises” that must be addressed. Chief among the unresolved issues are global warming, economic inequality, and structural economic change.

The market will not, on its own, solve any of these problems. Global warming is a quintessential “public goods” problem. To make the structural transitions that the world needs, we need governments to take a more active role – at a time when demands for cutbacks are increasing in Europe and the US.

…

As we struggle with today’s crises, we should be asking whether we are responding in ways that exacerbate our long-term problems. The path marked out by the deficit hawks and austerity advocates both weakens the economy today and undermines future prospects. The irony is that, with insufficient aggregate demand the major source of global weakness today, there is an alternative: invest in our future, in ways that help us to address simultaneously the problems of global warming, global inequality and poverty, and the necessity of structural change.

16.01.2013

Policy Points

In a recent talk hosted by NC Policy Watch, George Wentworth of the National Employment Law Project explains how proposed changes to North Carolina’s unemployment insurance system would negatively impact unemployed individuals and the larger economy and explains better ways of strengthening the unemployment insurance system.

16.01.2013

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity slowed in December, according to the latest survey by the Federal Reserve Bank of Richmond. Big ticket sales dropped this month, contributing to a fall in retail revenues. Inventories rose slightly. In addition, shopper traffic diminished and retailers indicated a more negative outlook for sales over the next six months. At non-retail services businesses, revenues flattened. In contrast to retail merchants, services providers remained optimistic about business prospects in the first half of the new year.

…

Labor indicators in the service sector weakened in December. The number of employees fell at both retail and non-retail establishments. While average wages grew on pace with a month earlier at services-providing firms, retail wages declined.

…

Price growth in the broad service sector hovered near November’s moderate pace. However, survey respondents expected somewhat faster overall price growth during the next six months.

15.01.2013

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region advanced for the second straight month, according to the Richmond Fed’s latest survey. Looking at the broad indicators of activity, new orders were virtually unchanged, shipments grew more slowly, and employment declined. Other indicators were mixed. Capacity utilization turned positive, while backlogs fell further. Moreover, the gauge for delivery times inched higher, while finished goods inventories grew at a slightly slower pace and growth in raw materials inventories edged higher.

…

Looking forward, assessments of business prospects for the next six months were less optimistic in December. An increasing number of contacts anticipated slower growth for most indicators with the exception of capital expenditures, which grew at a rate slightly above November’s rate.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed