27.10.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

27.10.2009

Policy Points

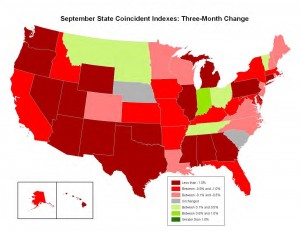

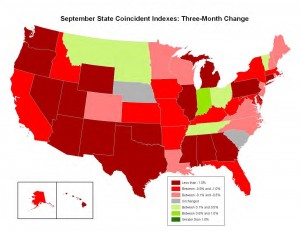

Economic conditions remained weak across much of the nation in September, according to the newest State Coincident Indexes Report prepared by the Federal Reserve Bank of Philadelphia.

In September coincident indexes moved in a negative direction in 39 states and in a positive direction in nine states (ID, IN, LA, MT, ND, OH, SD, TN, VT). No changes occurred in either North Carolina or Nebraska.

The map to the right, which is taken from the Reserve Bank’ survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

The map to the right, which is taken from the Reserve Bank’ survey, shows the three-month changes in coincident indicators by state. Positive numbers denote improvements in economic conditions, and negative numbers refer to declines.

Over the last three months,coincident indexes decreased in 41 states, rose in seven states (IN, MT, ND, OH, SD, TN, VT) and held steady in two states: Nebraska and South Carolina.

During the same period, North Carolina’s coincident index moved in a slightly negative direction, suggesting that economic conditions continued to deteriorate.

27.10.2009

Policy Points

In a new Economic Letter, the Federal Reserve Bank of San Francisco assessed current credit conditions and attempted to gauge the impact that monetary policy has had on credit rates. Concludes the Bank:

The indicators of aggregate credit conditions outlined in this article suggest that the Fed’s accommodative monetary policy stance during the financial crisis has worked to improve credit markets. The historical federal funds rate indicator declined from 3.1% in June 2007 to 1.7% by June 2009. At the same time though, these results also suggest that overall credit conditions since late 2007 have been tighter than might otherwise have been expected based on historical experience and that this tightness is partly offsetting the Fed’s policy actions.

26.10.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

26.10.2009

Policy Points

A weekend story in The News & Observer of Raleigh discussed changes to the work participation rules associated with the Work First program, North Carolina’s version of the federal Temporary Aid to Needy Families program. These alterations are needed to bring the state into compliance with recent changes in federal policy.

The N&O, however, missed the real story about Work First; namely, just how few adults receive assistance and how limited the program’s impact is.

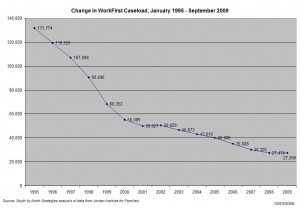

According to data compiled by the UNC Jordan Institute for Families, North Carolina had 27,566 Work First cases (non-diversion) in September. These cases involved 52,062 individuals (approx. 0.6 percent of the state population). Of the total cases, 65 percent involved only children while children accounted for 82 percent of the individuals receiving assistance. Additionally, the median payment in September equaled $236.

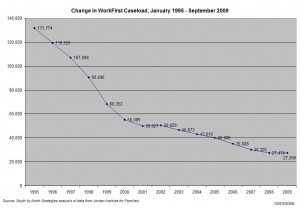

Since the “welfare reform” of the late 1990s, the Work First program has seen its significance as a social program decline sharply. The total caseload has fallen by 79 percent (graph, right), and the program now touches less than one percent of the state’s residents.

Additionally, the program is no longer reflective of larger economic conditions. Since the onset of the recession in December 2007 and September 2009, the monthly Work First caseload has remained relatively flat (down 0.3 percent).

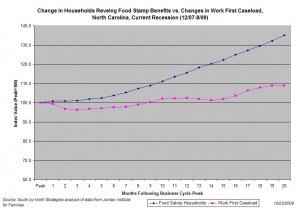

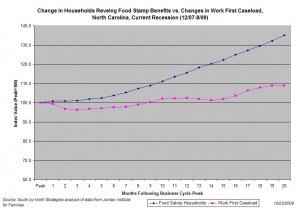

In contrast, the number of households receiving Food Stamp assistance has soared. Between the start of the recession and September 2009, the Food Stamp caseload grew by 35 percent. Last month, 1.3 million North Carolinians — approximately 14 percent of the state’s population — lived in a household receiving food assistance.

In contrast, the number of households receiving Food Stamp assistance has soared. Between the start of the recession and September 2009, the Food Stamp caseload grew by 35 percent. Last month, 1.3 million North Carolinians — approximately 14 percent of the state’s population — lived in a household receiving food assistance.

The disconnect between the directions of the Work First and Food Stamp caseloads (graph, above) illustrates just how small a role Work First plays in aiding families struggling with economic hardship.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed