15.10.2009

Policy Points

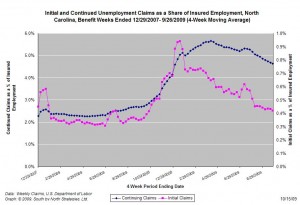

For the benefit week ending on September 26th, 16,383 North Carolinians filed initial claims for unemployment insurance, and 181,622 individuals applied for continuing insurance benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 16,785 initial claims were filed over the last four weeks, along with an average of 185,522 continuing claims. Both levels were down slightly compared to the previous four-week period. The four-week average for initial claims is now at the lowest level recorded since the period ending on November 1, 2008.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

Although new and continuing claims appear to have peaked for this cycle, the claims levels remain elevated and point to a labor market that remains extremely weak.

15.10.2009

Policy Points

In Foreign Affairs, Dean Baker of the Center for Economic and Policy Research debunks the claim that a shift in oil pricing from dollars to other currencies will harm the American economy. Writes Baker:

Any market — a stock market, a wheat market, or the oil market — requires a unit of measure. The importance of the U.S. economy made the dollar the obvious choice for most markets. But there would be no real difference if the euro, the yen, or even bushels of wheat were selected as the unit of account for the oil market. It’s simply an accounting issue.

Suppose that prices in the oil market were quoted in yen or bushels of wheat. Currently, oil is priced at about $70 a barrel. A dollar today is worth about 90 yen. A bushel of wheat sells for about $3.50. If oil were priced in yen, then the current price of a barrel of oil in yen would 6,300 yen. If oil were priced in wheat, then the price of a barrel of oil would be 20 bushels. If oil were priced in either yen or wheat it would have no direct consequence for the dollar. If the dollar were still the preferred asset among oil sellers, then they would ask for the dollar equivalents of the yen or wheat price of oil. The calculation would take a billionth of a second on modern computers, and business would proceed exactly as it does today.

The larger issue, notes Baker, is the dollar’s status as an international reserve currency, but even that issue is not as serious as often claimed.

read more

14.10.2009

Policy Points

Economic policy reports and media stories of interest:

14.10.2009

Policy Points

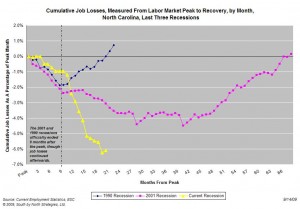

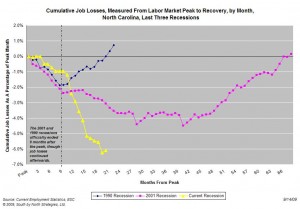

On Friday, the Employment Security Commission of North Carolina will release the employment report for September, the 21st month of the recession. As the downturn nears the two-year mark, where does the state’s labor market stand?

As of August, the recession had led North Carolina’s non-farm employers to eliminate, on net , 253,400 payroll positions. Consequently, payroll employment is now 6 percent smaller than it was in December 2007 (graph, left).

As of August, the recession had led North Carolina’s non-farm employers to eliminate, on net , 253,400 payroll positions. Consequently, payroll employment is now 6 percent smaller than it was in December 2007 (graph, left).

In terms of job losses, the current recession was a slow starter. Significant net losses did not start until fall 2009, with heavy losses occurring every month between 11/08 and 3/09. In fact, that period accounts for 64 percent of all the job losses that have occurred during the recession. Although the pace of job losses has moderated since April, the overall trend remains a downward one.

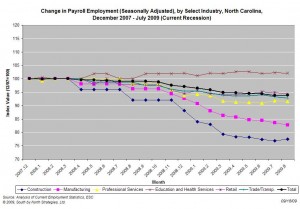

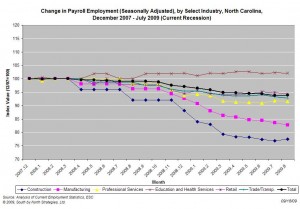

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

Job losses have been relatively widespread (graph, right). With the exception of the health care/education and government fields, payrolls have contracted in every major industry. The greatest numerical losses have occurred in manufacturing, construction, and professional services while the greatest proportional declines have occurred in construction and manufacturing.

read more

13.10.2009

Policy Points

Economic policy reports and media stories of interest:

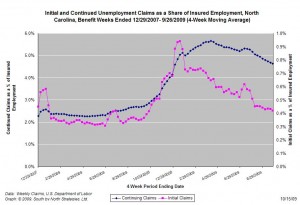

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed