15.01.2013

Policy Points

Writing at Naked Capitalism, Matt Stoller argues that corporate monopolies prevent Americans from enjoying high-quality services in areas like wireless communications.

What seems to have happened is that American corporate executives are now more focused on financial engineering, which is essentially the extraction of capital from their enterprises and from the public, than they are at selling improved goods and services. For example, GE just got a tax break extended which added $3 billion a year in annual profit in the latest fiscal cliff deal. That’s a lot of money, and not one good or service was improved to drop that cash to the bottom line. As another example, the cable industry is projecting an average monthly bill of $200 by 2020, versus $86 today. At 73 million subscribers, that’s an additional $100 billion a year of revenue. Comcast alone has 22 million customers – that’s $30 billion a year for this one company alone. And let’s be clear, this is not going to better products, Americans tend to get worse internet and cable service than counterparts around the world. Investing in manipulative pricing schemes, lobbying for tax breaks and not investing in good infrastructure is a rational choice for American corporate executives, since their ethic is to extract as much capital as possible from the American economy. And yet, this is why America can’t have nice things.

14.01.2013

Policy Points

Dani Rodrik explains how mercantilism remains alive and well and how the school of thought is coming into increasing conflict with economic liberalism.

Indeed, that, in a nutshell, is the story of the last six decades: a succession of Asian countries managed to grow by leaps and bounds by applying different variants of mercantilism. Governments in rich countries for the most part looked the other way while Japan, South Korea, Taiwan, and China protected their home markets, appropriated “intellectual property,” subsidized their producers, and managed their currencies.

…

We have now reached the end of this happy coexistence. The liberal model has become severely tarnished, owing to the rise in inequality and the plight of the middle class in the West, together with the financial crisis that deregulation spawned. Medium-term growth prospects for the American and European economies range from moderate to bleak. Unemployment will remain a major headache and preoccupation for policymakers. So mercantilist pressures will likely intensify in the advanced countries.

…

As a result, the new economic environment will produce more tension than accommodation between countries pursuing liberal and mercantilist paths. It may also reignite long-dormant debates about the type of capitalism that produces the greatest prosperity.

14.01.2013

Policy Points

From the Economic Policy Institute’s analysis of the November 2012 version of the Job Openings and Labor Turnover Survey (JOLTS) …

The November Job Openings and Labor Turnover Survey (JOLTS), released today by the Bureau of Labor Statistics, shows job openings were essentially flat in November, at 3.7 million (up by 11,000). The number of job openings, which had been improving fairly steadily since reaching its low of 2.2 million in July 2009, has stalled in recent months; there has been no improvement in job openings since March 2012.

…

Layoffs decreased by 17,000 in November. This is positive news, although layoffs are not currently the primary concern; as this figure shows, despite month-to-month volatility in the data, layoffs have been at prerecession levels for more than two years. The primary concerns in the labor market are job openings and hiring. Hires were essentially flat in November, up by 3,000. Like job openings, hires have made no progress since the first quarter of this year. This lack of progress is bad news because there is a long way to go before hiring returns to healthy levels, as it remains far below its prerecession level.

11.01.2013

Policy Points

Matt Taibbi of Rolling Stone reports on the “secret and lies of the bailout.”

It [the case for bailing out Wall Street] was all a lie – one of the biggest and most elaborate falsehoods ever sold to the American people. We were told that the taxpayer was stepping in – only temporarily, mind you – to prop up the economy and save the world from financial catastrophe. What we actually ended up doing was the exact opposite: committing American taxpayers to permanent, blind support of an ungovernable, unregulatable, hyperconcentrated new financial system that exacerbates the greed and inequality that caused the crash, and forces Wall Street banks like Goldman Sachs and Citigroup to increase risk rather than reduce it. The result is one of those deals where one wrong decision early on blossoms into a lush nightmare of unintended consequences. We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

…

But the most appalling part is the lying. The public has been lied to so shamelessly and so often in the course of the past four years that the failure to tell the truth to the general populace has become a kind of baked-in, official feature of the financial rescue. Money wasn’t the only thing the government gave Wall Street – it also conferred the right to hide the truth from the rest of us. …

10.01.2013

Policy Points

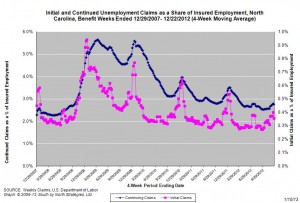

For the benefit week ending on December 22, 2012, some 15,367 North Carolinians filed initial claims for state unemployment insurance benefits and 107,706 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 13,429 initial claims were filed over the previous four weeks, along with an average of 104,173 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 14,777, and the four-week average of continuing claims equaled 118,495.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost five years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed