14.12.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

14.12.2012

In the News, Policy Points

A recent story in The Charlotte Observer reported on the 100,000 North Carolinians set to lose federal and state unemployment insurance at the end of the month. The report contained commentary fro John Quinterno of South by North Strategies, Ltd.

A bill recently unveiled in the state legislature by a Republican-controlled committee calls for reducing the maximum weeks of benefits to no more than 20 – and as few as 12 weeks when the unemployment rate is low. The bill also calls for reducing the maximum weekly benefits from $506 to $350.

…

“In the U.S. and in North Carolina, we have traditionally assumed that we don’t have long durations of unemployment, that unemployment is a very short phenomenon,” Quinterno said. “One of the things we have seen in the ‘great recession’ is that long-term joblessness has become an entrenched part of our labor market. We are dealing with large numbers of people who have been out of work for very long periods of time.”

…

And, he added, the longer people are out of work, the harder it is for them to find a job.

13.12.2012

Policy Points

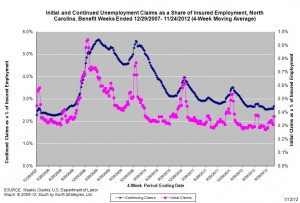

For the benefit week ending on November 24, 2012, some 22,174 North Carolinians filed initial claims for state unemployment insurance benefits and 111,905 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 14,047 initial claims were filed over the previous four weeks, along with an average of 100,824 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 14,599, and the four-week average of continuing claims equaled 112,122.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost five years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

12.12.2012

Policy Points

Economist Robert Frank isn’t buying arguments about the relationship between top marginal tax rates and job creation.

That realization appears to have led some Republicans to resurrect their time-honored claim that because many top earners own small businesses, higher top tax rates would severely compromise job creation. But that argument flies in the face of the basic cost-benefit test that governs rational hiring decisions. As every economics textbook on the subject makes clear, a business will hire additional workers whenever, and only whenever, their contribution to the bottom line promises to exceed their pay. If that criterion is satisfied, hiring makes economic sense, no matter how poor the business owner might be. And if it isn’t, no hiring will occur, even if the owner is a billionaire.

12.12.2012

Policy Points

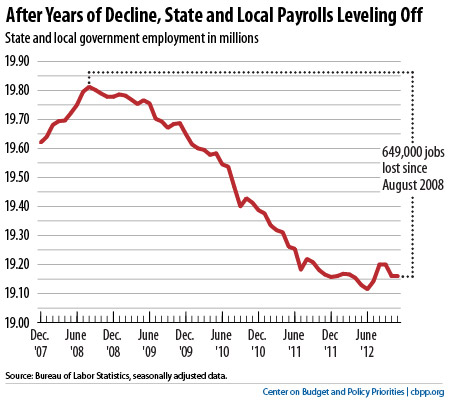

Off the Charts graphs the leveling off of job losses among state and local governments.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed