The Push To Privatize Social Security

(Via Naked Capitalism) A segment from The Real News Network discusses the growing pressures to privatize Social Security in the Obama administration.

(Via Naked Capitalism) A segment from The Real News Network discusses the growing pressures to privatize Social Security in the Obama administration.

Economic policy reports, blog postings, and media stories of interest:

For the benefit week ending on October 27, 2012, some 12,609 North Carolinians filed initial claims for state unemployment insurance benefits and 96,654 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

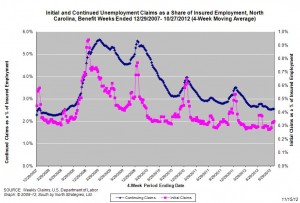

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 12,606 initial claims were filed over the previous four weeks, along with an average of 96,459 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 12,394, and the four-week average of continuing claims equaled 105,294.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.78 million versus 3.73 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 4.5 years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

From a recent article in The Economist about poverty in the United States. In addition to considering policy issues, the piece reports on the struggles of Americans living in Sumter, South Carolina.

That said, America is unusually reluctant, compared with other rich countries, about giving cash transfers to the poor. The country has a long-standing political aversion to anything that seems to “reward” being poor; instead, it fights poverty using a progressive, if somewhat paternalistic, tax code. The child tax credit allows families with incomes below a certain level ($110,000 for married parents filing jointly, or $75,000 for single-parent families) to claim a $1,000 credit against their federal income taxes for every dependent child. Though its reach extends into the solidly middle-class, its greatest impact is on the poor. Credits can often eliminate most of their tax liability ….

—

America’s most important tax-based cash-transfer programme is the earned income tax credit (EITC). It was originally enacted in 1975 as a means of encouraging the poor into the labour force, and has been extended and expanded enthusiastically since by both parties, most recently by Mr Obama in 2009. Unlike most tax credits, the EITC is refundable. Its amount varies with income and the number of dependants, but it is a credit amounting to a percentage of a taxpayer’s earned income. When that credit exceeds a payer’s tax liability, the government refunds the difference. Its benefits skew overwhelmingly toward families: the most a single person can claim is around $500, while a married couple with three or more dependent children can receive $5,000 or more. …

Economic policy reports, blog postings, and media stories of interest: