31.10.2012

Policy Points

The New York Times reports on the growth of part-time work in the American labor market.

The widening use of part-timers has been a bane to many workers, pushing many into poverty and forcing some onto food stamps and Medicaid. And with work schedules that change week to week, workers can find it hard to arrange child care, attend college or hold a second job, according to interviews with more than 40 part-time workers.

…

To be sure, many people prefer to work part time — for instance, college students eager for extra spending money and older people earning money for presents during the holiday season.

…

But in two leading industries — retailing and hospitality — the number of part-timers who would prefer to work full-time has jumped to 3.1 million, or two-and-a-half times the 2006 level, according to the Bureau of Labor Statistics. In retailing alone, nearly 30 percent of part-timers want full-time jobs, up from 10.6 percent in 2006. The agency found that in the retail and wholesale sector, which includes hundreds of thousands of small stores that rely heavily on full-time workers, about 3 in 10 employees work part-time.

30.10.2012

Policy Points

Noted economist Joseph Stiglitz lays out, in his opinion, “what’s at stake in this election.”

Putting all this together isn’t the politics of envy, as Romney’s camp likes to complain, or even about shaking a finger at the country’s real freeloaders. It’s about cold, hard economics. Tax avoidance and low rates on capital gains — and the inequality they amplify — are weakening our economy. Were the rich paying their fair share, our deficit would be smaller, and we would be able to invest more in infrastructure, technology and education — investments that would create jobs now and enhance growth in the future. While education is central to restoring America as a land of opportunity, all three of these are crucial for future growth and increases in living standards. Tax havens discourage investment in the United States. Taxing speculators at a lower rate encourages speculation and instability — and draws our most talented young people out of more productive endeavors. The result is a distorted, inefficient economy that grows more slowly than it should.

29.10.2012

Policy Points

Writing in The New York Times, German journalist Malte Lehming describes some of the lessons about American-style bureaucracy he has learned while living in the US.

I spent half a day hunting for a store with flashlights in stock, because a storm had knocked out our power. In five decades in Germany I have never experienced a single power failure, because the power lines are usually underground and well maintained.

…

Yes, we have long holidays. But we probably still work more than our American colleagues, because our buildings are intact, the infrastructure works and we don’t sit around in traffic jams every day because of road work.

…

So why do Americans look only at the bad side of Europe? Done right, with enough money, it is punctual, efficient and organized. One may call it socialist, but it makes life easier.

26.10.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the service sector moderated in October, according to the latest survey by the Federal Reserve Bank of Richmond. Although retail sales inched up, overall revenues were held in check by flat revenues at non-retail services firms. Inventory build-up slowed. Big-ticket sales drifted lower and shopper traffic declined. Looking ahead six months, survey participants anticipated restrained demand for goods and services.

…

In service sector labor markets, hiring remained stalled. The number of retail employees dropped, albeit by less than a month earlier, and hiring at services providers flattened. However, average wages strengthened.

…

Price increases nearly matched last month’s pace at non-retail services firms, while retail prices rose more quickly in October. Non-retail services firms expected the pace of price growth would pick up in the next six months, pushing up overall price change expectations for the broad service sector.

25.10.2012

Policy Points

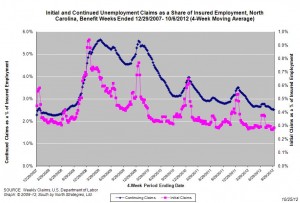

For the benefit week ending on October 6, 2012, some 12,266 North Carolinians filed initial claims for state unemployment insurance benefits and 95,507 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,784 initial claims were filed over the previous four weeks, along with an average of 94,826 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, but the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,270, and the four-week average of continuing claims equaled 103,658.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 4.5 years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed