28.09.2012

Policy Points

Matt Taibbi takes the fact that the presidential election is as close as it is as a powerful indictment of American elites.

With 300 million possible entrants in the race, how did we end up with two guys who would both refuse to bring a single case against a Wall Street bank during a period of epic corruption? How did we end up with two guys who refuse to repeal the carried-interest tax break? How did we end with two guys who supported a vast program of bailouts with virtually no conditions attached to them? Citigroup has had so many people running policy in the Obama White House, they should open a branch in the Roosevelt Room. It’s not as bad as it would be in a Romney presidency, but it comes close.

…

If this race had even one guy running in it who didn’t take money from all the usual quarters and actually represented the economic interests of ordinary people, it wouldn’t be close. It shouldn’t be close. If one percent of the country controls forty percent of the country’s wealth – and that trend is moving rapidly in the direction of more inequality with each successive year – what kind of split should we have, given that at least one of the candidates enthusiastically and unapologetically represents the interests of that one percent?

27.09.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

27.09.2012

Policy Points

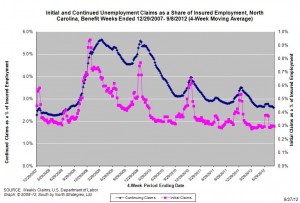

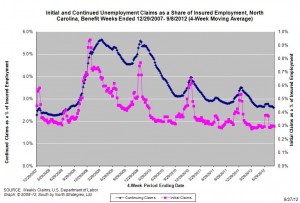

For the benefit week ending on September 8, 2012, some 11,321 North Carolinians filed initial claims for state unemployment insurance benefits and 97,127 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 11,176 initial claims were filed over the previous four weeks, along with an average of 98,227 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 11,319, and the four-week average of continuing claims equaled 105,641.

In recent weeks covered employment has increased and now exceeds the level recorded a year ago (3.77 million versus 3.72 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 4.5 years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

27.09.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity picked up moderately in September, according to the latest survey by the Federal Reserve Bank of Richmond. Strengthening revenues at non-retail services firms and a modest increase in retail sales pushed the broad sector revenues higher. Although cumulative retail sales edged up, big-ticket sales weakened; in addition, retail inventories grew more quickly this month. Shopper traffic remained nearly flat for a second month. Looking ahead, survey participants expected demand to continue to strengthen during the coming six months.

…

On the employment front, the number of retail employees and average retail wages dropped sharply. At non-retail services firms, hiring tapered off, while average wage increases intensified.

..

Prices increased at a restrained pace in the overall service sector in September, as both retail and non-retail prices rose more slowly. Looking to the six months ahead, survey participants expected prices in the broad service sector to climb at a quicker pace.

26.09.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed