19.09.2012

Policy Points

Mark Thoma thinks about what drives resentment toward supposed beneficiaries of government spending.

The worry, based upon a misunderstanding of who the beneficiaries of government spending actually are, is that Obama supporters will use their voting power to divert their hard-earned taxes to other people — the moochers — denying them of what they deserve. This group won’t find Romney’s remarks frightening at all, at least not until they begin to feel a Romney presidency puts their benefits in danger. It’s the (false) fear of not getting what they deserve that drives this group — they paid their dues and want into the club with the benefits they were promised. Romney’s problem, I think, or one of them anyway, is that many of them thought they were in Romney’s secret club, that Romney would protect them from “the others” no matter what he might actually say on the campaign trail. In doing so — by Romney denying the moochers — they’d be protected. But they are starting to realize that they may not be in the club — the one with $50,000 plates — after all.

19.09.2012

Policy Points

John Cassidy of The New Yorker makes a good point despite misidentifying the Economic Policy Institute.

Many educated people have little idea about the level of wages in this country. According to the Employment Policy Institute, more than half of all jobs pay less than thirty-four thousand dollars a year. A quarter of jobs pay less than twenty-three thousand dollars—the official poverty line for a family of four. The child tax credit and the earned-income tax credit were both designed to reward low-paying work rather than inactivity—that is why they attracted Republican support. They operate like a negative income tax—an idea Milton Friedman, yes that Milton Friedman, originally proposed—which tops up the incomes of the working poor and the working near-poor.

18.09.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

18.09.2012

Policy Points

Naked Capitalism asks if QE3 is “yet another stealth bank bailout.”

Note that there has not been a peep out of the Fed on the failure of the banks to lower borrower rates to reflect their cheaper funding costs. The central bank has a powerful bully pulpit, and if it were to make noise, you’d see Congresscritters and the media piling on. One wonders if the Fed has even broached the topic privately. I can imagine Jamie Dimon grousing about the loss of profits on float and the flatter yield curve justifying them taking margin wherever they find it, and the Fed unwilling to point out that the banks created the new normal and they need to adjust to it too.

…

So the Fed looks to be completely on board with this sort of rent-seeking. Perhaps the central bank believes its charges need more in the way of earnings to strengthen their balance sheets, even though history shows they prioritize executive bonuses over building their equity levels. Or maybe [Ben] Bernanke was being completely truthful when he said QE3 was targeting employment. After all, fatter bank margins will preserve their staffing levels.

18.09.2012

Policy Points

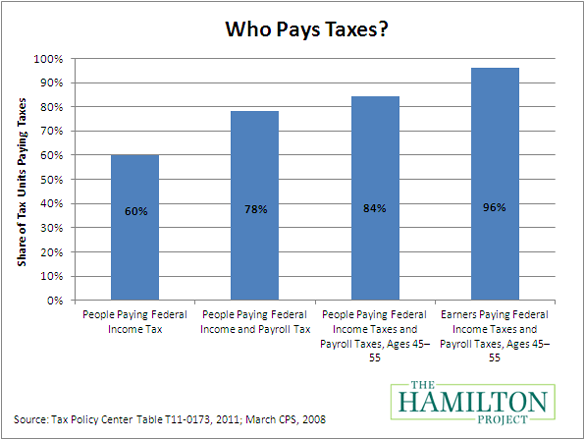

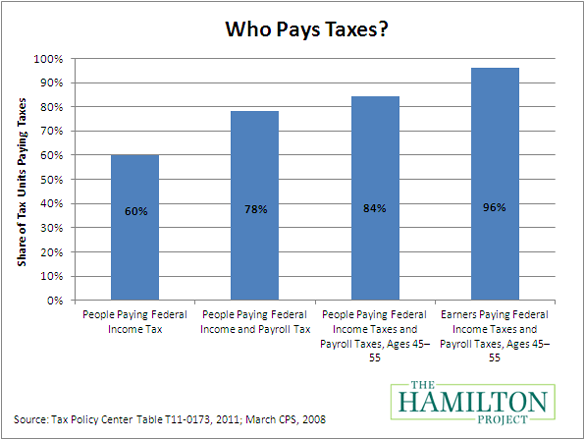

The Hamilton Project points out that “just about everyone” pays taxes.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed