17.09.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

17.09.2012

Policy Points

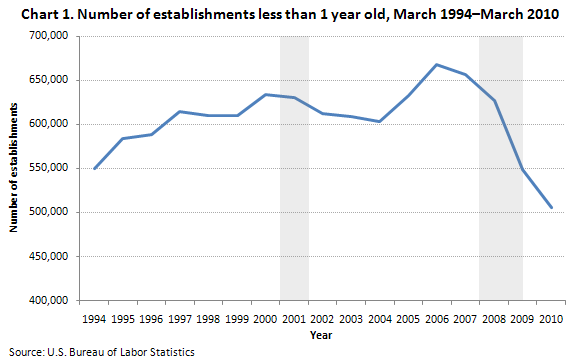

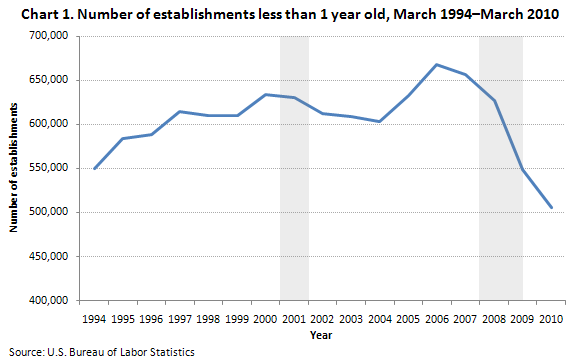

Felix Salmon looks at different ways at data related to start-up business activity during the course of the “Great Recession.”

17.09.2012

Policy Points

Rortybomb wonders if people should stop describing student loans as “financial aid.”

Student loans are a way of mitigating a credit constraint, which is different than providing aid. Here it reflects not subsidized demand, but actual demand smoothed over a long time period. That’s going to put a lot of demand into play. It shouldn’t surprise us that demand is very high when credit constraints are removed. Higher education is one of the most important mechanisms of social and economic mobility we have, and it is also one of the primary ways we have for people to fully develop their talents and capabilities.

…

If actual demand overwhelms the supply of the system, that’s a problem of supply, not demand. And the obvious solution is to increase the supply. Throughout our country’s history we’ve done that in landmark bills that do it through public provisoning paid for by taxation, bills like the Morrill Act and California Master Plan. Now, as that system is left to crumble, we are looking to the private, for-profit sector to fill that gap. I fear that will only exacerbate the cost problems we’ve seen so far, and the data is looking that way too.

14.09.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

14.09.2012

Policy Points

Nouriel Roubini sees a “hard landing” in store for the global economy.

Ineffective governments with weak leadership are at the root of the problem. In democracies, repeated elections lead to short-term policy choices. In autocracies like China and Russia, leaders resist the radical reforms that would reduce the power of entrenched lobbies and interests, thereby fueling social unrest as resentment against corruption and rent-seeking boils over into protest.

…

But, as everyone kicks the can down the road, the can is getting heavier and, in the major emerging markets and advanced economies alike, is approaching a brick wall. Policymakers can either crash into that wall, or they can show the leadership and vision needed to dismantle it safely.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed