30.08.2012

Policy Points

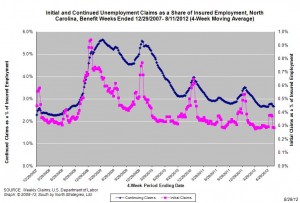

For the benefit week ending on August 11, 2012, some 11,114 North Carolinians filed initial claims for state unemployment insurance benefits and 101,529 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,787 initial claims were filed over the previous four weeks, along with an average of 100,636 continuing claims. Compared to the previous four-week period, the average number of initial claims was slightly lower, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 10,781, and the four-week average of continuing claims equaled 109,375.

In recent weeks covered employment has increased and now exceeds the level recorded a year ago (3.77 million versus 3.72 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 4.5 years ago.

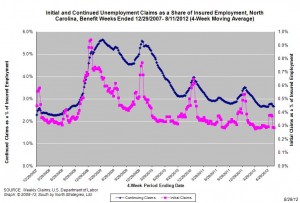

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

30.08.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Activity in the service sector was lackluster in August, according to the latest survey by the Federal Reserve Bank of Richmond. Big-ticket sales slumped and anemic shopper traffic contributed to weak retail sales. Inventories rose slightly and merchants looked for little change in the six months ahead. Revenues sagged at non-retail services firms, although those businesses anticipated a mild uptick by the early part of 2013.

…

In service sector labor markets, retailers left their number of employees unchanged and services providers made additions to their payrolls. Collectively, wage increases were more widespread this month.

29.08.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

29.08.2012

Policy Points

This week, John Quinterno of South by North Strategies, Ltd. delivered an overview of labor market conditions in North Carolina during the course of the “Great Recession” to students and faculty of the Department of City and Regional Planning at UNC-Chapel Hill. The presentation is below.

29.08.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region contracted at a less pronounced rate this month, after deteriorating in July, according to the Richmond Fed’s latest seasonally adjusted survey. Looking at the main components of activity, shipments edged higher, employment turned negative, and the weakness in new orders moderated somewhat. Evidence of diminished weakness was also reflected in most other indicators. District contacts reported that backlogs, capacity utilization, and delivery times remained negative but improved from July readings. Moreover, finished goods inventories grew at a slightly slower pace, while growth in raw materials was nearly unchanged.

…

Looking forward, assessments of business prospects for the next six months were generally in line with last month’s readings. Contacts at more firms anticipated steady growth in shipments, new orders, and backlogs in the months ahead, while they expected capacity utilization to grow more quickly.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed