26.07.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity weakened in July, according to the latest survey by the Federal Reserve Bank of Richmond. Shopper traffic dissipated and overall retail sales dropped, despite solid big-ticket sales. Retail inventories declined. The softness extended to non-retail services firms, where revenues also fell. Looking ahead six months, retail merchants remained unenthusiastic about sales. Services-providers’ expectations were subdued, compared to the previous month’s outlook.

…

Employment measures in the service sector also diminished in July. Survey participants reduced the number of employees at their establishments this month, and gains in average wages slowed.

..

Price increases in the broad service sector picked up somewhat this month. The six-month outlook for price change in the overall service sector was for faster price increases, compared to the current pace and to the outlook of a month ago.

26.07.2012

Policy Points

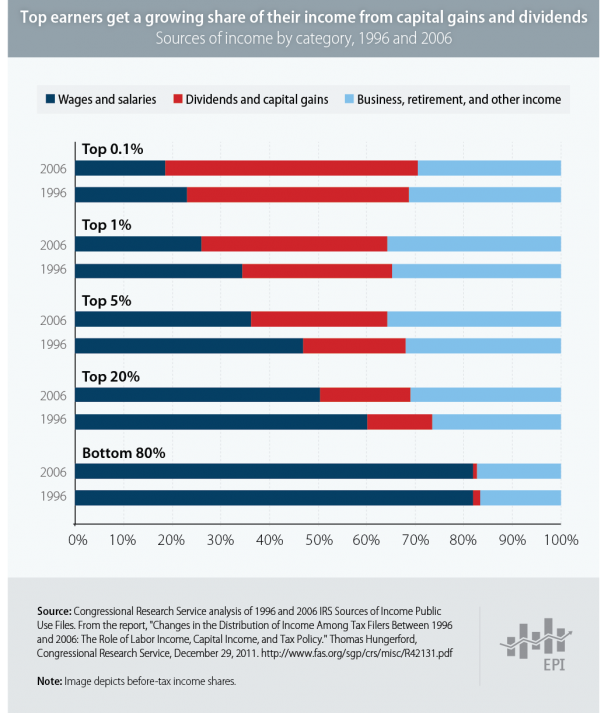

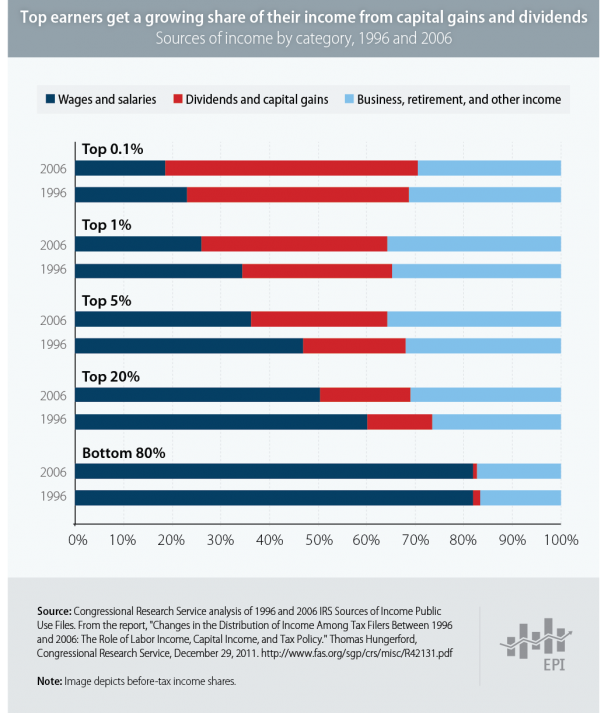

A new infographic from the Economic Policy Institute shows the sources from which various income groups derive their annual incomes. (Hint: the very rich are very different.)

25.07.2012

Policy Points

Economic policy reports, blog postings, and media stories of interest:

25.07.2012

Policy Points

From the Federal Reserve Bank of Richmond’s latest survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

The pullback in manufacturing activity in the central Atlantic region deepened in July, after edging lower in June, according to the Richmond Fed’s latest seasonally adjusted survey.* The index of overall activity was pushed lower as shipments and new orders declined further into negative territory. Employment remained in positive territory, but grew at a pace below June’s rate. Other indicators also suggested additional softness. District contacts reported that backlogs, capacity utilization, and delivery times continued to contract. Moreover, manufacturers reported that finished goods inventories grew at a much quicker pace, while raw materials were nearly unchanged.

…

Looking ahead, manufacturer’s optimism regarding future business prospects dropped considerably in July. An increasing number of firms anticipated slower growth across the board with the exception of capital expenditures, which grew at a pace slightly above June’s rate.

25.07.2012

Policy Points

Robert Skidelsky doesn’t buy the arguments that justify the growth in income inequality.

The growth of inequality leaves ideological defenders of capitalism unfazed. In a competitive market system, people are said to be paid what they are worth: so top CEOs add 263 times more value to the American economy than the workers they employ. But the poor, it is claimed, are still better off than they would have been had the gap been artificially narrowed by trade unions or governments. The only secure way to get “trickle-down” wealth to trickle faster is by cutting marginal tax rates still further, or, alternatively, by improving the “human capital” of the poor, so that they become worth more to their employers.

…

This is a method of economic reasoning that is calculated to appeal to those at the top of the income pyramid. After all, there is no way whatsoever to calculate the marginal products of different individuals in cooperative productive activities. Top pay rates are simply fixed by comparing them to other top pay rates in similar jobs.

…

In the past, pay differentials were settled by reference to what seemed fair and reasonable. The greater the knowledge, skill, and responsibility attached to a job, the higher the acceptable and accepted reward for doing it.

…

But all of this occurred within bounds that maintained some connection between the top and the bottom….

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed