NC Unemployment Claims: Week Of 11/2/13

For the benefit week ending on November 2, 2013, North Carolinians filed some 7,115 initial claims for state unemployment insurance benefits and 71,033 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,573 initial claims were filed over the previous four weeks, along with an average of 70,488 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was higher.

One year ago, the four-week average for initial claims stood at 12,900, and the four-week average of continuing claims equaled 97,116.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

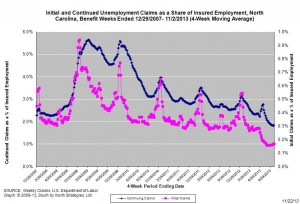

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,573) was 49 percent lower than the figure recorded one year ago (12,900), while the average number of continuing claims was 27.4 percent lower (70,488 versus 97,116). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

NC Unemployment Claims: Week Of 10/26/13

For the benefit week ending on October 26, 2013, North Carolinians filed some 6,877 initial claims for state unemployment insurance benefits and 70,053 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,436 initial claims were filed over the previous four weeks, along with an average of 70,367 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,606, and the four-week average of continuing claims equaled 96,459.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

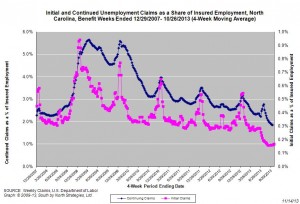

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,436) was 48.9 percent lower than the figure recorded one year ago (12,606), while the average number of continuing claims was 27 percent lower (70,367 versus 96,459). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

NC Unemployment Claims: Week Of 10/12/13

For the benefit week ending on October 12, 2013, North Carolinians filed some 6,083 initial claims for state unemployment insurance benefits and 70,775 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,170 initial claims were filed over the previous four weeks, along with an average of 71,342 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,169, and the four-week average of continuing claims equaled 96,185.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.84 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 5.5 years ago.

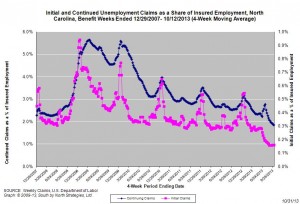

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,170) was 49.3 percent lower than the figure recorded one year ago (12,169), while the average number of continuing claims was 25.8 percent lower (71,342 versus 96,185). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

National Labor Market Goes Nowhere In Sept.

CHAPEL HILL, NC (October 22, 2013) – The national labor market added in September 148,000 more jobs than it lost. While the unemployment rate and the number of unemployed persons essentially held steady over the month, joblessness remained pervasive throughout the country. Last month, 11.3 million Americans were unemployed, while 7.9 million individuals worked part time despite preferring full-time positions. Another 852,000 individuals (not seasonally adjusted) were so discouraged about their job prospects that they had stopped searching for work altogether.

“September marked the 36th-straight month of job growth recorded in the United States,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Over the past year, the national economy netted an average of 185,000 jobs per month, a pace that, while positive, is insufficient to drive unemployment down to pre-recessionary levels. The pace of growth slowed sharply during the past three months, falling to an average monthly net gain of 114,000 jobs from an average of 116,000 jobs per month during the prior three-month period.”

In September, the nation’s employers added 148,000 more payroll positions than they cut. Gains occurred overwhelmingly in the private sector (+126,000), while government employers added 22,000 more positions than they eliminated, due mainly to hiring by state governments. Furthermore, the payroll employment numbers for July and August underwent revisions; with the updates, the economy netted 282,000 jobs over those two months, not the 273,000 positions previously reported.

Within the private sector, payroll levels rose the most in the trade, transportation, and utilities sector (+60,000, with 34.7 percent of the gains occurring in the retail trade subsector), followed by the professional and business services sector (+32,000, with 75.9 percent of the gain occurring in the administrative and waste services subsector) and the construction sector (+20,000). Payroll levels fell the most in the leisure and hospitality services sector (-13,000, due primarily to cuts in the accommodation and food services subsector).

“Since last September, the American economy has gained 2.2 million more payroll positions that it has lost,” noted Quinterno. “The current average monthly rate of job growth—some 185,000 positions per month—is insufficient to close the nation’s sizable jobs gap anytime soon.”

Slack labor market conditions were evident in the September household survey. Last month, 11.3 million Americans (7.2 percent of the labor force) were jobless and seeking work. Both the unemployment rate and total number of unemployed persons essentially were unchanged from the prior month. In September, the share of the population participating in the labor force was unchanged at 63.2 percent, a rate lower than the one posted a year ago. On a positive note, more Americans were working in September compared to a year earlier, and fewer persons were unemployed. At the same time, the share of the working-age population with a job remained near the lowest figure recorded during the current business cycle.

Last month, the unemployment rate was higher among adult male workers than female ones (7.1 percent versus 6.2 percent). Unemployment rates were higher among Black (12.9 percent) and Hispanic workers (9 percent) than among white ones (6.3 percent). The unemployment rate among teenagers was 21.4 percent. Moreover, 6.5 percent of all veterans were unemployed, and the rate among recent veterans (served after September 2001) was 10.1 percent. At the same time, 13.1 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained hard to find in September. Last month, the underemployment rate equaled 13.6 percent. Not only were 11.3 million Americans unemployed, but 7.9 million individuals worked part-time jobs despite preferring full-time work. Another 852,000 individuals (not seasonally adjusted) were so discouraged about the labor market that they had stopped searching for work. Among unemployed workers, 36.9 percent had been jobless for at least six months, and the average spell of unemployment equaled 36.9 weeks. The leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 52 percent of unemployed persons. Another 28.3 percent of unemployed persons were re-entrants to the labor market, while 10.9 percent were new entrants. Voluntary job leavers accounted for the remaining 8.8 percent of the total.

“The September employment report points to a labor market that is sputtering,” observed Quinterno. “Last month, job growth slowed and underemployment remained elevated. Despite the recent drop in the unemployment rate to the lowest level recorded since late 2008, joblessness and the associated hardships remain pervasive throughout the country.”

NC Unemployment Claims: Week Of 9/14/13

For the benefit week ending on September 14, 2013, North Carolinians filed some 6,111 initial claims for state unemployment insurance benefits and 73,162 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,038 initial claims were filed over the previous four weeks, along with an average of 75,881 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 10,369, and the four-week average of continuing claims equaled 96,252.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.84 million versus 3.77 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 5.5 years ago.

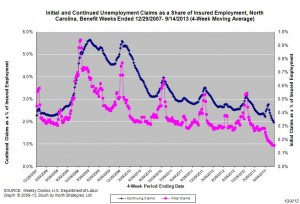

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,038) was 41.8 percent lower than the figure recorded one year ago (10,369), while the average number of continuing claims was 21.2 percent lower (75,881 versus 96,252). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed